Did you know that 40% of cryptocurrency traders lose money in their first year on Binance Trading?

This fact shows how vital it is to know how to trade on Binance before starting. It’s not just about jumping into digital assets without a plan.

Binance is a top cryptocurrency exchange, giving traders big chances in the digital money world. It supports over 500 cryptocurrencies. This means traders have a wide range of options but need to be smart and careful.

To do well on Binance, you need more than just excitement. Winners know that knowing a lot, being disciplined, and planning ahead are key. These steps help avoid big losses and make the most of your investments.

Key Takeaways

- Understand the complexity of cryptocurrency trading platforms

- Develop robust risk management strategies

- Learn from experienced traders’ experiences

- Stay informed about market trends and volatility

- Continuously educate yourself about Binance trading techniques

Understanding Binance Trading Fundamentals

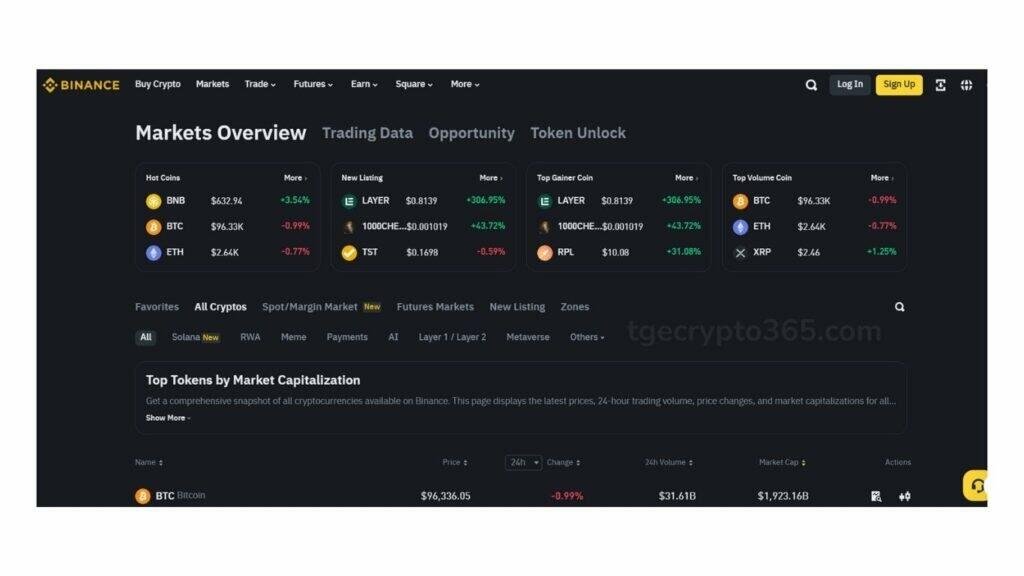

Cryptocurrency trading has changed digital finance a lot. Binance is a big name in this change. It’s the world’s largest cryptocurrency exchange. It gives traders a full platform to explore digital asset markets.

What Makes Binance Unique

Binance stands out for several reasons:

- Support for over 750 cryptocurrency pairs

- Processing capacity of 1.4 million orders per second

- Competitive trading fees

- Advanced trading tools and features

Key Platform Features

The Binance platform has strong tools for trading:

| Feature | Description |

|---|---|

| Order Types | Market, limit, stop-limit, OCO orders |

| Payment Methods | Bank deposits, credit/debit cards, digital wallets |

| Supported Currencies | EUR, USD, GBP |

Getting Started with Binance

Setting up a Binance account is easy. First, download the Binance app from the official site. Then, log in with your personal info. It usually takes 24-48 hours to verify your account.

Pro Tip: Enable two-factor authentication during binance account setup to enhance security.

Traders can use Binance Earn for passive income. They can also try different trading strategies with the platform’s tools.

The Psychology Behind Successful Trading Decisions

“The elements of good trading are: (1) cutting losses, (2) cutting losses, and (3) cutting losses.” – Ed Seykota

Trading psychology is key to success on Binance. Emotional smarts can greatly influence a trader’s success. Studies show that 93% of traders fail in two years, mainly because of emotional decisions, not strategy.

For beginners, understanding trading psychology is vital. Emotions like fear and greed play a big role. In fact, 80% of traders let these emotions guide their decisions.

Key Psychological Challenges in Trading

- Fear: Triggering panic selling during market volatility

- Greed: Leading to excessive risk-taking and over-leveraging

- Overconfidence: Increasing position sizes after consecutive wins

| Emotional Factor | Trading Impact |

|---|---|

| Fear | Premature selling, missed opportunities |

| Greed | Risky trades, ignoring risk management |

| Overconfidence | Increased position sizes, possible big losses |

Successful trading on Binance requires emotional control. Traders who plan well can see a 30% improvement in success. Taking breaks and staying positive are also key for long-term success.

For those new to Binance, the platform helps manage emotional challenges. It’s important to trade with a calm, disciplined mind. Emotional control is just as important as knowing the technical side of trading.

Improper Risk Management in Binance Trading

Risk management is key for beginners in binance trading. Without it, traders face big financial problems in the crypto market.

“The first rule of trading is to protect your capital” – Professional Crypto Traders

Learning about risk management in a binance trading course is important. It includes several key parts:

- Position Sizing: Never risk more than 1-2% of your total trading capital on a single trade

- Stop-Loss Orders: Automatically limit losses by setting exit points

- Diversification: Spread investments across many cryptocurrencies to reduce risk

Statistics show how vital risk management is. For example, a trader with 20x leverage in Ethereum can lose everything with just a 5% price drop. The goal is to have a 2:1 risk-to-reward ratio, aiming for a 1.5:1 ratio at least.

| Risk Management Strategy | Recommended Approach |

|---|---|

| Maximum Trade Risk | 1-2% of total trading capital |

| Leverage Usage | Minimal and carefully calculated |

| Portfolio Diversification | Multiple cryptocurrency investments |

The crypto market is very volatile. Traders must be careful and keep adjusting their strategies to protect their money in this fast-changing world.

Overtrading and Its Impact on Portfolio Performance

Overtrading is a big problem for crypto investors on Binance. Many think that being always active in the market means success. But, being patient is really important for a healthy trading portfolio.

“Not every market movement requires a trade. Sometimes, the best action is no action.”

Overtrading can really hurt your portfolio’s performance. Here are some surprising facts:

- 60% of new traders overtrade within their first year

- Too much trading can cut your portfolio’s value by up to 10% each year

- Almost 80% of retail trader losses come from quick, emotional decisions

A binance trading bot can lower the risk of overtrading. It uses set rules to make trades, taking out emotional choices. This way, trades are made based on clear rules.

| Trading Behavior | Potential Portfolio Impact |

|---|---|

| Frequent Unplanned Trades | 10-15% Performance Reduction |

| Emotional Decision Making | Up to 30% Capital Loss |

| Lack of Trading Plan | 50% Lower Success Rate |

When you manage your Binance wallet, make strict trading rules. Decide when to enter and exit trades, limit how often you trade, and use stop-loss orders. These steps help avoid quick, emotional trades and keep your money safe.

Key Strategies to Prevent Overtrading:

- Make a detailed trading plan

- Use a binance trading bot for steady trades

- Do careful market analysis

- Set strict daily trade limits

- Keep checking and changing your strategies often

Technical Analysis Mistakes to Avoid

Technical analysis is a key skill in Binance trading, but it comes with risks. Knowing these risks helps in building a strong trading strategy. This strategy uses tools like TradingView well.

Common Chart Pattern Misinterpretations

Chart patterns can be tricky, mainly for those without strong analytical skills. Many traders make big mistakes when reading technical signals:

- Misidentifying trend reversals

- Overlooking volume confirmation

- Failing to validate pattern reliability

Indicator Analysis Errors

Technical indicators like RSI and MACD need careful understanding. Key mistakes include:

- Relying solely on single indicators

- Misinterpreting overbought/oversold conditions

- Ignoring broader market context

| Indicator | Common Mistake | Correct Approach |

|---|---|---|

| RSI | Assuming automatic reversal | Confirm with additional signals |

| MACD | Neglecting crossover context | Analyze trend strength |

Time Frame Selection Issues

Choosing the wrong time frames can affect Binance trading rate analysis. Short-term traders often overlook the value of multi-timeframe analysis. Successful traders use different time frames to understand the market better.

Technical analysis deals with probabilities, not absolutes. Every indicator and pattern needs careful evaluation.

By grasping these technical analysis details, traders can cut down on mistakes. This helps in refining Binance trading strategies with precise TradingView tools and detailed market analysis.

The Dangers of Emotional Trading

Emotional trading is a big challenge for those investing in cryptocurrencies, like on Binance. Traders in Binance India and worldwide face psychological barriers. These can really hurt their investment results.

“Emotions are the silent killer of trading success” – Professional Crypto Trader

Research shows some interesting facts about emotional trading:

- 70% of traders experience loss aversion

- 60% admit fear significantly influences trading decisions

- 90% of novice traders fail within their first three months

Knowing about binance trading fees can help avoid emotional trading. When traders manage costs wisely, they’re less likely to act on fear or greed.

Some major dangers of emotional trading are:

- Panic Selling: Triggered by market volatility

- FOMO (Fear of Missing Out): Causing rushed investments

- Overconfidence: Leading to excessive risk-taking

Successful traders use strategies to fight emotional trading:

- Develop a structured trading plan

- Set strict entry and exit points

- Practice mindfulness techniques

- Use stop-loss orders

By knowing their emotional triggers and using disciplined methods, traders can do better on platforms like Binance.

Understanding Binance Trading Fees and Costs

Trading in cryptocurrencies can be complex, and knowing about fees is key. Binance’s fees can greatly affect your investment strategy and profits. It’s important to keep costs low to make more money.

Fee Structure Breakdown

Binance has a clear fee structure for traders. The standard fee is 0.1% per trade. This fee is the same for spot and margin trading, making Binance competitive.

| Fee Type | Standard Rate | Discounted Rate |

|---|---|---|

| Standard Trading Fee | 0.1% | 0.075% |

| Instant Buy/Sell | 0.50% | N/A |

| Credit/Debit Card Purchase | Up to 3.75% | N/A |

Cost Minimization Strategies

There are ways to lower costs on your Binance account:

- Use Binance Coin (BNB) for a 25% fee discount

- Increase trading volume to qualify for lower fees

- Utilize maker orders to potentially reduce transaction costs

- Monitor VIP level status for additional commission reductions

Impact of Fees on Profitability

Small fee differences can have a big impact on your trading performance. A 0.1% fee might seem small, but it adds up over time. Traders should think about fees when planning their strategies.

Smart traders view fees not just as expenses, but as critical components of their overall trading economics.

Understanding Binance’s fees and using smart strategies can help investors. This way, they can improve their trading and protect their profits.

Leverage and Margin Trading Risks

Margin trading is a powerful but risky strategy in places like Binance and Bybit. It lets traders increase their gains by using leverage. But, this method also comes with big risks that need to be understood well.

Leverage lets traders handle bigger positions with less money. For example:

- Initial investment: $1,000

- Leverage: 10x

- Effective trading power: $10,000

The chance for big gains is matched by the risk of big losses. With a binance trading tutorial, investors can learn how to manage risks:

- Set strict stop-loss orders

- Limit leverage to 5x-10x for beginners

- Maintain adequate margin balance

| Leverage Ratio | Initial Margin | Potential Risk |

|---|---|---|

| 5x | 20% | Moderate |

| 10x | 10% | High |

| 20x | 5% | Very High |

Warning: A 1% price movement with high leverage can trigger significant losses or complete liquidation.

“Leverage is a double-edged sword – it can multiply gains, but it can also amplify losses beyond your initial investment.” – Cryptocurrency Trading Expert

Bybit and Binance offer different leverage options, from 5x to 100x. Experienced traders suggest starting with lower leverage. Then, increase it as you get to know the market better.

Market Analysis and Timing Errors

Trading on Binance is not just about luck. It’s about understanding the market and timing. Knowing how to analyze market cycles and trends is key. This knowledge helps you make better trading decisions.

Market Cycle Recognition

Learning about market cycles is essential. Cryptocurrency markets go through different phases:

- Accumulation: Smart money starts buying

- Markup: Prices go up, more people get interested

- Distribution: Market excitement peaks

- Markdown: Prices drop as the market corrects

Entry and Exit Strategy Optimization

Timing is everything in trading. In 2023, scams made $241.6 million. To protect your money, you need good strategies:

- Know when to buy and sell

- Use stop-loss orders

- Don’t make emotional decisions

- Keep an eye on the market

Trend Analysis Fundamentals

Understanding trends is vital for success. By knowing market trends, you can make smarter choices. Important techniques include:

- Finding support and resistance levels

- Using moving averages

- Looking at volume indicators

- Studying price patterns

“The key to successful trading is not predicting the market, but responding to it intelligently.” – Experienced Crypto Trader

A good binance trading course can teach you these skills. It helps you handle the market’s ups and downs.

Security Best Practices for Binance Trading

Keeping your binance account safe is key in the world of crypto trading. Binance, with over 150 million users, has strong security to protect your money and keep hackers out.

Here are some important steps to keep your binance wallet safe:

- Enable two-factor authentication (2FA)

- Use strong, unique passwords

- Whitelist withdrawal addresses

- Implement anti-phishing codes

Binance’s security is top-notch. They keep 90% of cryptocurrencies in cold wallets, making it hard for hackers to get in. They also have a $1 billion safety fund for users.

| Security Feature | Protection Level |

|---|---|

| Two-Factor Authentication | Required for login and withdrawals |

| Withdrawal Freeze | 24-48 hours for suspicious activity |

| Cold Storage | 90% of assets stored offline |

“Protecting your cryptocurrency investments starts with understanding and implementing robust security measures.” – Crypto Security Expert

Binance has faced challenges, like a $40 million hack in 2019. But they’ve always helped users and made their security better. The U.S. Binance has never had a security issue.

Remember, a safe binance account is your best defense in crypto trading.

Essential Tools and Resources for Successful Trading

Trading cryptocurrencies well needs the right tools and resources. TradingView is key, with over 30 million users every month. It offers advanced charting and analysis. The Binance trading bot helps by making trades fast.

Keeping track of your portfolio is vital. Tools like CoinTracker and Delta help over 1 million traders. They see a 30% boost in success in their first year. This shows the value of the right tools for trading.

Advanced traders find TradingView boosts their success by 15%. Binance offers over 600 trading pairs and automated options. Its Grid Trading bot lets traders profit from market changes without constant watching.

About 80% of new traders lose money at first. This is often because they lack the right tools and knowledge. Using technical analysis, price alerts, and learning platforms can improve trading and lower risks.

TradingView Integration

TradingView has great charting that works well with Binance. Traders can make custom indicators and set price alerts. They can also do detailed analysis to make smart trades.

Portfolio Tracking Solutions

Portfolio tracking tools are important for monitoring investments. They help analyze performance and make informed decisions. Platforms like CoinTracker give a full view of your crypto across different exchanges.

Market Analysis Tools

Advanced tools for market analysis are key. They include on-chain analytics and sentiment analysis. These tools give deep insights into market trends and opportunities. They are vital for complex trading strategies.

FAQ

Is Binance safe for trading?

Binance uses strong security like two-factor authentication and withdrawal address whitelisting. It also has anti-phishing codes. While no site is completely safe, Binance is known for its security.

How do I get started with Binance trading?

First, visit the Binance website and create an account. Then, complete the verification and enable two-factor authentication. Link a payment method and get familiar with the platform. Start with small trades to learn.

What are the common psychological mistakes in trading?

Traders often make mistakes like acting out of fear or greed. They might also get too attached to their trades or lack discipline. Successful traders control their emotions, plan their trades, and make decisions based on facts.

How can I manage risk effectively on Binance?

To manage risk, set stop-loss orders and diversify your portfolio. Use the right position sizes and know your risk tolerance. Never risk more than you can afford to lose. It’s wise to risk 1-2% of your capital per trade.

What are Binance trading fees?

Binance’s fees are competitive, around 0.1% for standard trading. Using Binance Coin (BNB) can give you discounts. Fees change based on your volume and account type, so check the current fees.

Can beginners use Binance?

Yes, Binance is great for beginners. It has a user-friendly interface and educational resources. Start small, practice on demo accounts, and keep learning.

How do I withdraw money from Binance?

To withdraw, go to the withdrawal section. Choose your currency, enter the address, and specify the amount. Be aware of minimum limits and network fees.

What tools can help improve my Binance trading?

Tools like TradingView and portfolio tracking apps are helpful. They offer advanced charting and market analysis. Trading bots can also improve your strategy.

Is leverage trading recommended on Binance?

Leverage trading can increase gains but also risks. It’s for experienced traders who understand the risks. Start with low leverage and have a strict risk plan.

How can I avoid overtrading?

Avoid overtrading by having a clear plan and setting daily limits. Stay away from emotional decisions and focus on quality trades. Use trading bots to remove emotions from your strategy.

Disclaimer:

I am not a Financial Advisor. This content is for informational purposes only. Always consult a qualified professional before making financial decisions.

[…] you ready to take your cryptocurrency trading to the next level in 2025? 🚀 With the rapid evolution of digital assets and trading […]